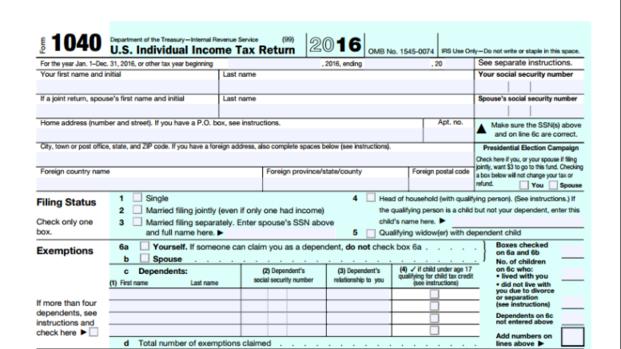

Now that we're into 2017, many people are ready to file their 2016 income tax returns. It's fun if you've had too much withheld and you are expect a refund of the overpayment you've made. Many people tell me that they just use the information from their December Leave and Earnings Statement (LES) to do their taxes. While I appreciate the enthusiasm, there are four good reasons to wait.

You Can't File Until 23 January 2017

Even if you do your taxes today, the tax filing season doesn't open until 23 January 2017. You can, and probably should, start your preparation sooner, and electronic tax filers can accept tax returns earlier, but nothing will be opened or transmitted to the IRS until 23 January 2017. Preparing your return early, or even mailing it early, will not make your return come any faster.

It’s The Rules

According to the IRS,

"Authorized IRS e-file Providers are prohibited from submitting electronic returns to the IRS prior to the receipt of all Forms W-2, W-2G, and 1099-R from the taxpayer.

If the taxpayer is unable to secure and provide a correct Form W-2, W-2G, or 1099-R, the return may be electronically filed after Form 4852, Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. is completed in accordance with the use of that form. This is the only time information from Pay stubs or Leave and Earning Statements (LES) is allowed."

I know that people DO file without waiting for their W-2, and you can do whatever you want. However, the IRS says it is not OK. I see no reason to try to upset the IRS on purpose, so I suggest waiting until your W-2 is available.

Adjustments Happen

Your tax information may change occur after your December LES is published. This can happen because the December LES is calculated before the end of the month, and doesn't include last minute adjustments to pay or allowances. It can also happen when there are mistakes, which (as well all know) happens all the time with the military. If you file your taxes based on your December LES, and that information changes, you will then have to file an amended tax return later when you get the final documents. It's a pain and unnecessary.

Those Other W-2s

Your regular W-2 does not always include all your taxable compensation. Other things that will generate a special W-2 include:

- personally procured moves (PPM), previously known as Do It Yourself (DITY) moves, will generate a special travel W-2,

- interest earned in a Savings Deposit Program (SDP) account,

- Voluntary Separation Incentive (VSI) and Special Separation Bonus (SSB) payments, and

- Student Loan Repayment Program (SLRP) payments.

Most of these special W-2s will be available via MyPay prior to 31 January 2017. VSI and SSB W-2s are not available online and will be mailed between 5-12 January 2017.

When you've withheld too much during the year, it's normal to be excited about a refund of those overpayments. However, doing your taxes early isn't going to make your refund come faster, and filing an amended return is a hassle. Wait for the tax statements to be released, so you can make sure that your first tax return filing is totally correct.

Other great tax-related content:

From The Mailbag: Are Military Uniforms Tax Deductible?

How To Report Tricare on Your Tax Return

2016 Military Tax Statements Release Dates

What Is Income Tax Withholding and Why You Want To Get It Right